Recent investigations conducted in various regions of Nigeria have uncovered a troubling scarcity of currency, directly conflicting with the Central Bank of Nigeria’s (CBN) assurances of ample cash flow. Reports from Abuja, Lagos, Kano, Kwara, Gombe, Edo, Sokoto, and Ekiti indicate inconvenience faced by both bank customers and Point of Sale operators due to the widespread shortage.

This scarcity comes amidst a legal battle stemming from the CBN’s attempt to redesign N200, N500, and N1000 notes, aimed at reducing currency circulation. Former CBN Governor Godwin Emefiele’s initiative, announced in October 2022, faced legal challenges leading to a Supreme Court ruling in March 2023 that extended the notes’ validity until December 2023. Despite efforts by the CBN to extend the validity indefinitely, the shortage persists despite reported increases in currency circulation according to CBN reports.

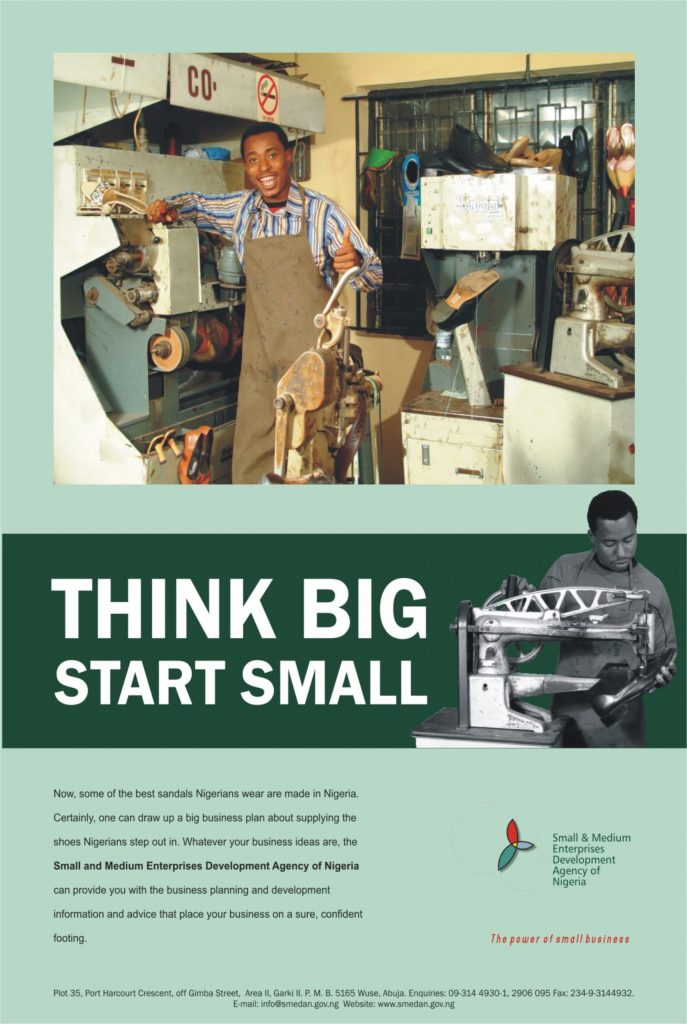

The ramifications of this scarcity extend across various sectors, especially impacting businesses heavily reliant on cash transactions. Daily operations are facing disruptions, potentially resulting in substantial revenue losses, particularly among small-scale enterprises. Moreover, citizens are experiencing financial strain due to limited cash access, impacting essential needs and purchasing power. The added burden of increased charges by Point of Sale operators exacerbates the situation for individuals.

This crisis poses significant economic threats, potentially contributing to an economic slowdown and market uncertainty. Moreover, it risks widening the financial exclusion gap with a potential shift towards digital payment solutions, leaving segments of the population behind. Urgent collaborative efforts between authorities and financial institutions are critical to ensure cash availability, explore alternative payment solutions, and reinstate confidence in the economy.

In conclusion, addressing the root causes of the scarcity while prioritizing digital financial inclusion remains pivotal. Clarity, assurance, and immediate action from regulatory authorities and financial institutions are essential to mitigate the crisis’s impact and stabilize the Nigerian economy.